We Stand for America’s Seniors.

As a grass-roots, non-profit organization formed in 1991, RetireSafe educates and advocates on behalf of senior Americans on issues including Social Security, Medicare, health, safe retirement and financial well-being. Subscribe to our newsletter to learn more about how We Stand For You!

Message from the president

RetireSafe’s Vision for 2026

RetireSafe envisions an America where Seniors are well informed and actively engaged in healthy living and their own care; where robust healthcare is readily available and affordable; where individual choice is maintained and sustainable public programs are available and efficient for those who need them.

We are committed to protecting and strengthening Medicare and Social Security so they remain reliable, accessible, and responsive for today’s seniors and future retirees. RetireSafe will continue to champion commonsense healthcare reforms that improve affordability, expand access to quality care, and prioritize prevention, chronic care management, and long-term supports for older adults.

At the same time, we envision communities that make Aging in Place not only possible, but practical—where seniors can remain safely in their homes with access to healthcare, transportation, housing modifications, and caregiver support that preserve independence and quality of life.

Guided by the voices and experiences of retirees and near-retirees, RetireSafe will serve as a trusted advocate and resource—working to ensure policies reflect the realities of aging, protect earned benefits, and promote a healthier, more secure future for all older Americans.

Sincerely,

Our Legislative Priorities:

In Memoriam

Jimmy Carter: Remembering the 39th U.S. President

James Earl “Jimmy” Carter, the 39th President of the United States, passed away on December 29th, at 100 years old. He died peacefully, surrounded by family at his home in Plains, Georgia. He was the oldest living Former President in U.S. History.

Jimmy Carter was a selfless humanitarian both in his presidency and beyond, receiving the 2002 Nobel Peace Prize for his efforts in establishing The Carter Center, an organization dedicated to improving life for people around the world.

The folks at RetireSafe honor his legacy of peace, diplomacy, and humanitarian work.

Contribute to our Mission

Join RetireSafe’s Board of Directors

Job Description:

RetireSafe, Inc. is seeking dedicated individuals to join our Board of Directors. As a member of the Board, you will play a crucial role in guiding the organization’s mission to advocate for senior Americans on issues such as Social Security, Medicare, health, safe retirement, and financial well-being.

Location:

Remote with two on-site meetings per year (on-site address can be found in the footer at the bottom of the page)

Key Responsibilities:

Key Responsibilities:

Qualifications:

Qualifications:

How to Apply:

Interested candidates should submit a resume and a cover letter detailing their interest in joining the Board of Directors to Mark Gibbons at mark@retiresafe.org.

2024 Presidential Election

Washington, DC (November 12, 2024) – RetireSafe issued the following statement regarding the election of Donald Trump as the next President of the United States of America.

“We extend our congratulations to the newly-elected President of the United States, Donald Trump. Moving forward, RetireSafe is eager to work with his Administration to promote healthcare policies that will protect America’s aging population. Although we have reached the end of a tough election season, the real work lies ahead as we pursue a pro-patient agenda that will better the lives of our nation’s seniors. This includes protecting and strengthening Medicare and addressing policies that disrupt and worsen seniors’ access to high-quality healthcare.

RetireSafe urges President-elect Trump to work alongside the new Congress to enact legislation that ensures access to essential medications. Seniors, many of whom are on fixed incomes and require multiple medications to treat various conditions, need leaders who will champion their healthcare needs and concerns. This includes protecting and preserving Social Security and Medicare, which allow them to access their much-needed medications.”

Learn more

Stay informed on issues relevant to you.

Legislation

Learn more about upcoming legislation, laws and what our elected officials are working on.

Get Involved

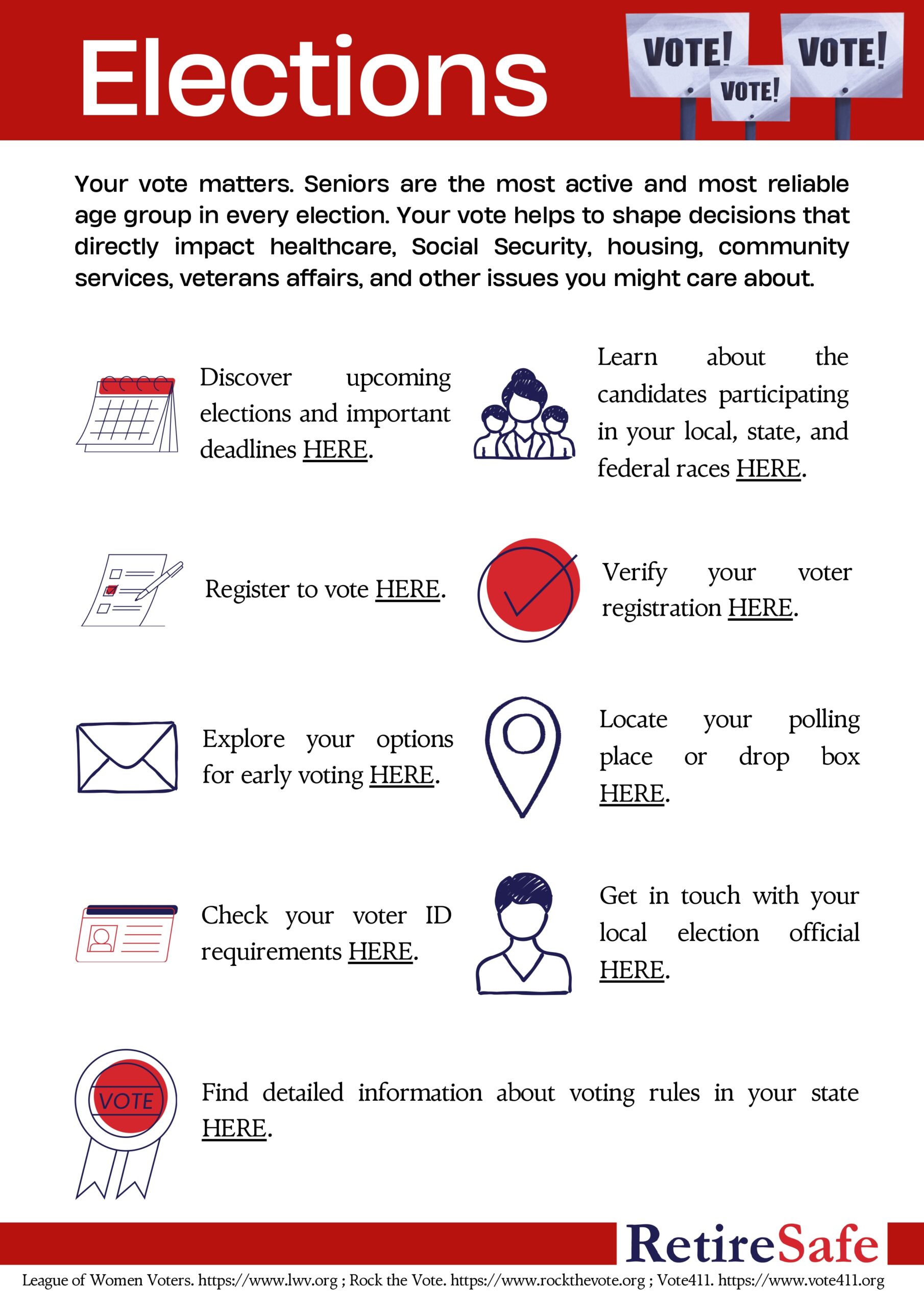

Exercise your right to VOTE!

RetireSafe’s efforts to educate and advocate mean very little if they are not backed by your vote! We have compiled an Election Guide below with trusted resources, websites, and key information to help you participate in your local elections. Every election is an opportunity to make your voice heard and protect the future you helped build. RetireSafe strongly encourages you to do your part and VOTE!

Share Your Story

Help us advocate for better solutions.

Your voice matters! Please take a moment to fill out our latest survey and empower us to fight for the rights and needs of seniors across America. Together, we can make a significant impact.

Join Us

Reach out & be a part of our latest events

Stay informed on issues that matter to you, gain valuable insights from experts, and learn how you can advocate for your rights and well-being through our upcoming events.

28

May

Medicare & More

11

Jun

Supporting our Veterans

Our Mission

Your voice and rights matter.

RetireSafe is dedicated to safeguarding and enhancing the welfare, freedom, and rights of seniors by actively engaging in advocacy and providing educational resources.